When you start thinking about buying a home, what’s the first thing that comes to mind? Is it the location, the number of bedrooms, or which school district you want to be in? While all of those are important, the very first thing you should consider is how much you can afford. Everything else falls into place after you figure out your budget.

So, before you dive into browsing listings, here are a few crucial questions to ask yourself:

- What is my credit score, and can it be improved?

- How much do I have for a down payment?

- What does my monthly budget allow me to comfortably pay?

Let’s break each of these down.

Understanding Your Credit Score

One of the first things you need to know is your credit score, which you can pull online from various sources. However, it’s a good idea to consult with a trusted lender who can give you personalized advice. If your score is below 580, you may need to work on it before moving forward, and lenders often provide tips, like paying off specific debts, to improve your chances of qualifying for a loan. If your credit needs more extensive help, they can recommend reputable credit repair services. Be cautious, though—some credit repair services charge hefty fees with little return, so choose wisely.

Here’s a breakdown of typical credit score categories:

- Excellent: 800–850

- Very Good: 740–799

- Good: 670–739

- Fair: 580–669

- Poor: 300–579

Remember, your credit score not only impacts your loan options but also your insurance rates. The higher your score, the more money you could save in the long run.

How Much Can You Afford?

Once you know your credit score, the next step is to figure out what you can afford each month. According to financial experts, about 33% of your income should go toward housing. With the average American household income around $87,869 after taxes, this means you could budget around $2,400 a month for your mortgage.

Don’t forget to factor in potential tax benefits of homeownership. Speak with your CPA to understand how these could increase your spendable income, making homeownership more affordable.

Key Factors That Affect Home Prices

As you start looking at homes, three major factors will influence price:

- Location – Homes in less expensive areas might mean a longer commute to work, so you’ll have to balance the cost of living with the convenience factor.

- Size – If this is your first home, you might need to consider something smaller than you initially want. However, home values typically increase, so this could just be a stepping stone to a larger home in the future.

- Condition – “Starter homes” are often smaller or lack the high-end features you might see in more expensive homes. If you’re handy, a fixer-upper could be a great way to build “sweat” equity.

How Much Should You Put Down?

Down payment requirements vary based on the type of loan. For a conventional loan, you’ll need at least 3%, while FHA loans require a minimum of 3.5%. Veterans are eligible for VA loans with $0 down, and some rural areas qualify for USDA loans with no down payment as well.

If you’re short on the down payment, consider starting a savings plan or expanding your home search to USDA-qualified areas. For instance, nearby Royse City has several new builds under $300,000 that qualify for a 0% down USDA loan. These homes range from 1,390 to 1,724 square feet and feature 3 bedrooms, 2 bathrooms, and a 2-car garage. Plus a new build equates to less for utilities due to energy effect standards and little to no maintenance.

Conclusion: Can You Afford a Home?

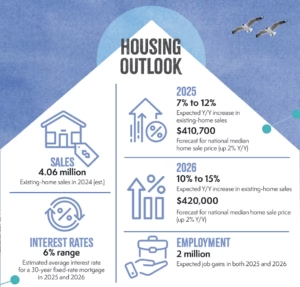

Absolutely, you can! But it might require some trade-offs. If you have a good credit score (620+), you very possibly could qualify for a 6-7% interest rate, allowing you to purchase a $300,000 home with a down payment of $10,500. Your estimated monthly mortgage payment would be around $2,112.

If you’re not quite there yet on the down payment, it’s time to start saving or look at areas where you can qualify for a 0% down loan. Either way, homeownership is within reach—you just need a solid plan and a little patience.

Jerry Welch, Realtor

Jerry Welch is a full-time, professional REALTOR® with over 17 years in real estate and specializes in helping seniors’ transition. He holds an SRES (Senior Real Estate Specialist) designation, which reflects his extensive education on topics such as tax laws, probate, estate planning, and equity conversion strategies. He offers relevant information on current market trends as well as being a valuable resource regarding real estate transactions. He was one of the founding members and is a past chair of the Rockwall Chamber SSA (Senior Services Alliance) Program. (972) 800 3915 https://jerrywelch.ebby.com/