Last updated on May 8, 2024

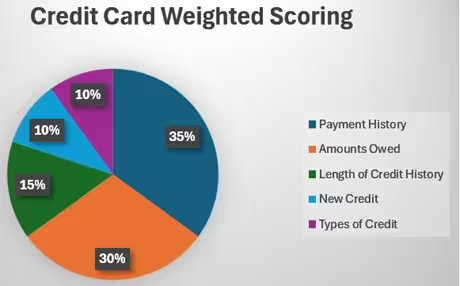

What Makes up Your Total Credit Score

As a potential homebuyer, you may find that poor credit is an obstacle to buying a home. The below information can provide you with resources and information to help you better understand your credit and how you can possibly improve it. While there are services that charge a fee for assistance, below are several examples of free tools you can use to learn about the importance of credit and ways to improve it.

Five Components that Determine your Credit Score

Payment History

35% of your credit score is determined by your payment history. Simply, make your debt payments on time. Late payments are reported to credit agencies and can damage your credit.

Amounts Owed

30% of your credit score is determined by your outstanding debt. Managing the amount, you own versus your available credit is heavily weighted in determining your credit score. For example, if you have a credit card with $1,000 limit and you have a balance of $998 your score may be negatively impacted. It is best to keep your balances at or below 30% of what is available.

Length of Credit History

There is a direct positive impact on your credit score the longer you can show a history of being a responsible account holder and it accounts for 15% of your credit score. However, opening new accounts can negatively impact your credit score. It is important to keep this in mind with all the available credit opportunities for consumers. It might not be worth the 20% discount on your first purchase if you apply for the store’s credit card.

Types of Credit

10% of your credit score is determined by the mix of account types that you have. These include revolving (credit card), installment, (auto, student loan, etc.), and mortgage accounts. It is important to have a good balance of revolving, installment, and mortgage accounts within your credit profile.

New Credit

10% of your credit score is determined by the number of new accounts you have. Credit inquiries and changes to businesses pulling your credit are factored into this category. If you are frequently opening new accounts it can negatively impact your credit score. It is important to understand that not all credit is created equal. When shopping for a mortgage, credit inquiries made in the 30 days prior to the scoring request are ignored in the FICO scoring. This allows you to shop for a mortgage without potentially damaging your score in the process.

Now that you understand what drives your credit score, now it is time to look at some tools to help you improve it.

Develop Credit Education

Equifax has a series of educational videos on credit scores. The information explains how to improve a credit score and how it is calculated. Learn More

MyFico offers educational articles, videos, and answers to FAQs on credit. Learn More

Affordability Calculator

Nerdwallet’s affordability calculator provides you with a breakdown of a potential monthly payment for a house based on location and other financial factors, including credit score. Learn More

Score Goals

American Express offers a free tool for you to improve their credit score. Called Score Goals, the program generates personalized recommendations based on the consumer’s desired score. Learn More

Consumer Information

The Consumer Financial Protection Bureau gives you resources to learn how credit reports work, the differences between credit reports and credit scores, and your rights as a consumer. Learn More

Congratulations

Now you know what makes up your credit score and how to verify yours and improve it.

The bases for the above material and referred sites came from an article in February’s Texas REALTOR® article and information taken from a Prosperity Home Mortgage flyer. It is provided for information purposes only and do not constitute an endorsement nor a recommendation.

Jerry Welch, Realtor

Jerry Welch is a full-time, professional REALTOR® with over 17 years in real estate and specializes in helping seniors’ transition. He holds an SRES (Senior Real Estate Specialist) designation, which reflects his extensive education on topics such as tax laws, probate, estate planning, and equity conversion strategies. He offers relevant information on current market trends as well as being a valuable resource regarding real estate transactions. He was one of the founding members and is a past chair of the Rockwall Chamber SSA (Senior Services Alliance) Program. (972) 800 3915