Picture waking up one day, completely free of stress, knowing that every aspect of your financial future is secure and prepared for whatever life brings. With rising living costs and growing financial uncertainties, taking control of your financial future has never been more important. Comprehensive financial planning offers a clear, structured approach to managing your finances—helping you achieve both short-term goals and long-term security. Whether you’re saving for your child’s education, planning for retirement, or protecting your wealth, having a solid plan in place can make all the difference.

The Benefits of a Holistic Approach

Comprehensive financial planning takes a holistic view, integrating every aspect of your finances, from savings and investments to insurance, taxes, and estate planning. By considering your financial life as a whole, this approach helps avoid the common pitfalls that come with focusing on just one area, like saving for retirement or paying down debt.

For example, many Rockwall residents may focus on building a retirement nest egg but overlook how taxes might affect those savings down the road. Others may work to eliminate debt but neglect to set up an emergency fund, leaving them vulnerable in case of unexpected expenses. A comprehensive plan helps ensure you’re financially prepared for both everyday life and future goals.

Preparing for Life’s Changes

Life is full of transitions, from buying a home to planning for college or retirement. A comprehensive financial plan helps you navigate these changes by providing a roadmap that adjusts as your circumstances evolve. In Rockwall, where families are often juggling multiple financial priorities, a flexible financial plan can help you make informed decisions and avoid costly mistakes.

A sound financial plan prepares you for both expected milestones and unexpected events like health challenges or career changes. This way, you can face life’s transitions with confidence, knowing your finances are aligned with your goals

Avoiding Fragmented Planning

Many people take a fragmented approach to financial planning, tackling one area at a time without considering how decisions in one area impact another. For instance, someone might focus on aggressively saving for retirement but ignore tax strategies, which could lead to higher taxes down the road, in what we call “The RMD Tax Bomb.” Similarly, neglecting life insurance or estate planning can leave families unprotected.

Our residents often face multiple financial goals—whether saving for college or paying off a mortgage —and a piecemeal approach can create inefficiencies and missed opportunities. Comprehensive financial planning ensures that all parts of your financial life work together, maximizing your ability to reach your goals.

The Value of Professional Guidance

While there are many online tools and resources available to help you manage your finances, they often fall short of offering the personalized insight needed for your specific plan. A Certified Financial Planner (CFP®) brings professional expertise to the table, helping you craft a wealth strategy tailored to your unique situation.

Here, where families, retirees, and small business owners each face distinct financial challenges, having a CFP® can be especially beneficial. A Certified Financial Planner can guide you through complex areas like tax-efficient investing, retirement planning, and estate management, ensuring your financial plan is both effective and resilient.

Planning for Rockwall’s Growing Community

As Rockwall grows, so do the financial opportunities and challenges facing local residents. The rise in home values, shifts in the local economy, and broader financial trends all affect the way we manage our finances. Comprehensive planning helps you take advantage of these local opportunities while managing the associated risks.

For instance, rising property values might offer a chance to build wealth, but also come with higher property taxes and living costs. A financial plan can help you navigate these changes, whether you’re a young family, nearing retirement, or enjoying your golden years.

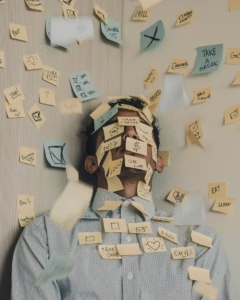

Easing Financial Stress

Money management can often feel overwhelming, especially when juggling multiple financial priorities. A comprehensive financial plan provides clarity and peace of mind, allowing you to focus on what matters most—your family, your community, and your future.

Conclusion: A Secure Future Starts with a Plan

For Rockwall residents, comprehensive financial planning isn’t just a smart financial decision—it’s a necessity. With our community’s growth and the ever-changing financial landscape, taking a holistic approach to your finances is the best way to ensure long-term security.

Now is the time to take charge of your financial future. Whether you’re just starting out or preparing for retirement, having a comprehensive plan in place will provide the clarity and confidence you need to achieve your financial goals and build a secure future for you and your family.

James Woodall, CFP®

Director of Financial Planning | Vice President | Financial Advisor

James Woodall is a seasoned financial professional and current Director of Financial Planning, Vice President, and Financial Advisor at Burrows Capital Advisors. He brings a wealth of experience, including founding Woodall Wealth Management, which was acquired by Burrows in 2024. James holds a BA in International Economics from Texas Tech and a Financial Planning Certificate from Southern Methodist University. He’s distinguished by his CFP® designation and has held key roles at Fidelity, Hilltop Securities, and Avantax. Passionate about helping individuals achieve financial success, James remains committed to providing personalized financial guidance and staying at the forefront of industry developments.