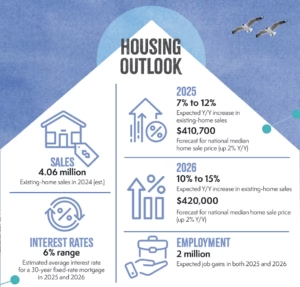

In Rockwall County, we are seeing an increase in the number of homes on the market and the average sales prices are holding steady. Days on Market are slightly up. However, when I compare them to this time last year the number of available homes went up by over 300 units, but the median sales price went down by $25,000.

Given these insights, it seems like a transitional period in the local housing market, where increased inventory and fluctuating prices are impacting buyer and seller strategies. Staying informed about financing options like FHA and Conventional loans can be crucial for both parties in making well-informed decisions amidst evolving market conditions.

FHA Loan vs. Convention Loan—What’s the Difference?

When purchasing a home, your buyer clients may have questions on which path to take in acquiring a loan. The two most common loan types are conventional and FHA. But what’s the difference between the two? Understanding the pros and cons of these loans can help you discuss options with your clients and answer their questions. Remember not to operate outside the scope of your real estate license; a mortgage professional can help your clients with specifics and advice.

Down Payments and Credit Scores

Buyers with a lower credit score may prefer an FHA loan. It requires a minimum credit score of 580 to be eligible for a 3.5% down payment. If a buyer holds a credit score between 500-579, that borrower could qualify for a 10% down payment. Despite the minimum scores of FHA loans, lenders could set higher standards.

For conventional loans, buyers can potentially receive a mortgage with a down payment of 3% if they have a credit score of 620 or higher.

Mortgage Insurance

For FHA loans, whether a buyer is required to have mortgage insurance will depend on the amount and term of the loan as well as the size of the down payment. The premiums for FHA mortgage insurance will last for the life of the loan if the down payment is below 10%. Otherwise, the buyer will pay the insurance for 11 years. It will also include an upfront fee that can be financed into the mortgage.

For conventional loans, borrowers need to pay for mortgage insurance if the down payment is less than 20%. While FHA loans require insurance regardless of the down payment amount, conventional loans can remove the mortgage insurance once a buyer has 20% equity in the home. Buyers who choose a conventional loan may also find cheaper private mortgage insurance if they have a credit score above 720.

Mortgage Rates

While FHA loans typically offer lower rates than conventional loans, it may not be worth it in the long run for some buyers. As stated above, an FHA loan’s mortgage insurance will last at least 11 years or till the loan is paid off, depending on the size of the down payment. If a buyer expects to reach 20% equity in a home in less than 11 years, then the higher conventional loan rate may save more money in the long run.

Property Standards

The condition and intended use of a property also make a difference. With FHA loans, homebuyers must live in the house as their primary home. Requirements also include an FHA appraiser assessing the market value of the property and conducting a home inspection noting the property’s safety, soundness of construction, and adherence to local code restrictions.

For conventional loans, the property’s market value is the top concern, while some of the restrictions for FHA properties do not apply. A conventional loan can be applied to properties that may become a vacation home, an investment property, or used as a primary residence.

Refinancing

If your homebuyer ever intends to refinance their mortgage, an FHA loan may provide an easier path. The buyer will only be required to provide evidence of the property being a primary residence.

Meanwhile, to refinance a conventional loan, the buyer usually will need to provide at least a month of paychecks, W-2s from the previous two years, bank and investment account statements, most recent tax returns, a copy of the homeowner’s insurance policy, and their most recent mortgage statement.

In short, FHA loans are more suited to homebuyers with low credit scores. They could require higher down payments, stricter property standards, and a longer term of paying for mortgage insurance compared to conventional loans. If your buyers have a credit score above 720, then a conventional loan may be the more apt route for them. They allow smaller down payments, more flexible property standards, and don’t typically require mortgage insurance for as long. While your knowledge of financing may come in handy during discussions, remember to always recommend your homebuyers discuss loan options with qualified lending professionals before they decide the best path for them.

I hope you found the above article helpful. Let me close with a few tips if you’re thinking about purchasing a home soon.

Choose a Trusted REALTOR®: Start by connecting with a REALTOR® whom you trust. They will provide invaluable guidance throughout the home-buying process.

Work with a Local Lender: It’s essential to partner with a local lender who can assess your financial situation and help determine a realistic budget for your home purchase.

Affordability Considerations: While determining how much home you can afford, remember that it’s wise not to stretch yourself to the maximum limit. Factor in potential increases in taxes and insurance over time when planning your budget.

Timely Document Submission: To expedite the mortgage process, respond promptly to your lender’s requests for documentation. This helps keep the process moving smoothly.

Pre-Approval vs. Pre-Qualification: Seek pre-approval from your lender rather than just pre-qualification. Pre-approval involves a thorough review of your financial background by underwriters, making you as credible as a cash buyer when you find the right home.

By following these steps and working closely with your REALTOR® and lender, you can position yourself effectively in the competitive housing market and make informed decisions that align with your financial goals and capabilities.

Jerry Welch, Realtor

Jerry Welch is a full-time, professional REALTOR® with over 17 years in real estate and specializes in helping seniors transition. He holds an SRES (Senior Real Estate Specialist) designation, which reflects his extensive education on topics such as tax laws, probate, estate planning, and equity conversion strategies. He offers relevant information on current market trends as well as being a valuable resource regarding real estate transactions. He was one of the founding members and is a past chair of the Rockwall Chamber SSA (Senior Services Alliance) Program. (972) 800 3915