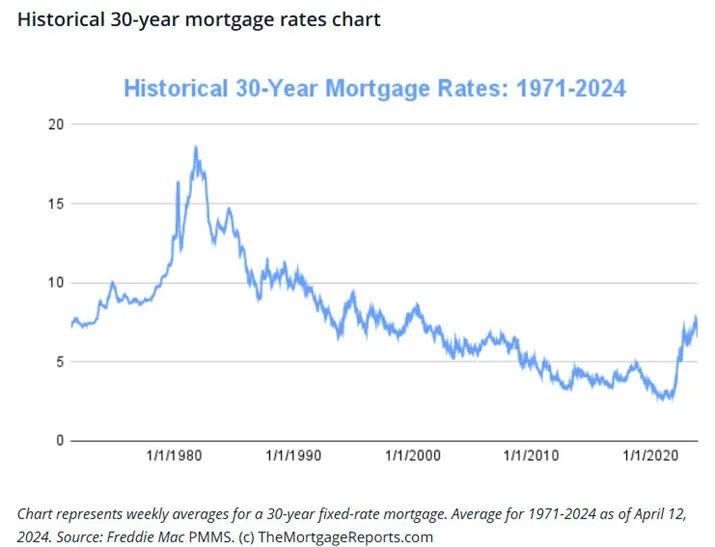

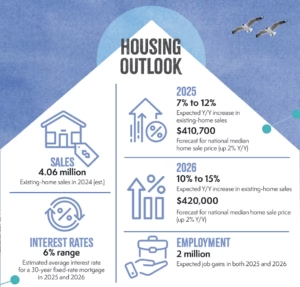

Potential home buyers often compare current interest rates of 6% to 7% with the much lower rates of around 3% seen in recent years, making today’s rates seem high. However, a historical view over the past 30 years shows that a 7% rate is actually below the long-term average.

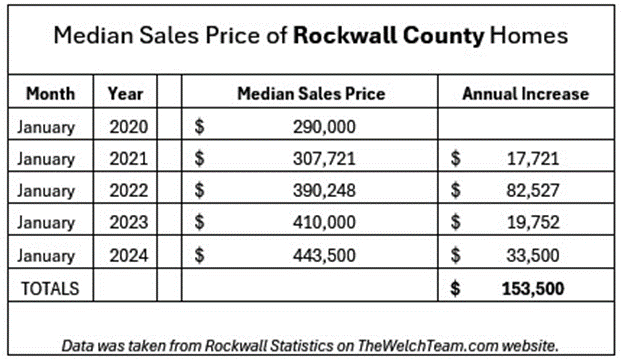

At 7%, you might not be able to purchase as large a home as you could at lower rates, but waiting for rates to drop might not be the best strategy. For example, in Rockwall County, the median sales price has risen from $290,000 in January 2020 to $443,500 in January 2024.

This is an average annual increase of $30,700, resulting in a $153,500 gain over five years. Such a return on investment is hard to find elsewhere. While not every year may see such aggressive growth, our area generally performs better than national averages, demonstrating strong home value appreciation.

7 Great Reasons to Own a Home

In addition, to the above financial consideration, below are 7 additional reasons to buy a home, as pointed out by the National Association of REALTORS®

Appreciation. Historically, real estate has had long-term, stable growth in value and served as a good hedge against inflation. Census data shows the median price of a home jumped from $172,900 in Q4 2000 to $417,700 in Q4 2023. That’s greater than 6% appreciation per year on average.

Equity. Money paid for rent is money that you’ll never see again, but paying your mortgage month over month and year over year lets you build equity ownership interest in your home.

Tax benefits. If you itemize deductions on your federal tax return, the U.S. Tax Code lets you deduct the interest you pay on your mortgage, your property taxes (up to $10,000 according to current tax law), and some of the costs involved in buying a home. Be sure to talk to your accountant to see if it’s advantageous for you to itemize.

Savings. Building equity in your home is a ready-made savings plan. And when you sell, you can generally exclude up to $250,000 ($500,000 for a married couple) of gain without owing any federal income tax. The IRS provide guidance(link is external) on how to qualify for the exclusion.

Predictability. Unlike rent, your fixed-rate mortgage payments don’t rise from year to year. So, as a percentage of your income, your housing costs may actually decline over time. However, keep in mind that property taxes and insurance costs may increase.

Freedom. The home is yours. You can decorate any way you want and choose the types of upgrades and new amenities that appeal to your lifestyle.

Stability. Remaining in one neighborhood for several years allows you and your family time to build long-lasting relationships within the community. It also offers children the benefit of educational and social continuity.

Did you know, according to Alexa, that the average annual income of a person renting is $42,500, whereas for homeowners, it’s $86,000? That’s more than double the income of renters.

So, when is the right time to buy a home? The answer is NOW, unless you plan on relocating within the next one or two years.

Currently, in Rockwall County, there are 148 homes with 3 bedrooms, 2 baths, and a 2-car garage available, starting at $255,990. The current market offers opportunities for buyers to find homes that fit their needs and budget.

Jerry Welch, Realtor

Jerry Welch is a full-time, professional REALTOR® with over 17 years in real estate and specializes in helping seniors’ transition. He holds an SRES (Senior Real Estate Specialist) designation, which reflects his extensive education on topics such as tax laws, probate, estate planning, and equity conversion strategies. He offers relevant information on current market trends as well as being a valuable resource regarding real estate transactions. He was one of the founding members and is a past chair of the Rockwall Chamber SSA (Senior Services Alliance) Program. (972) 800 3915