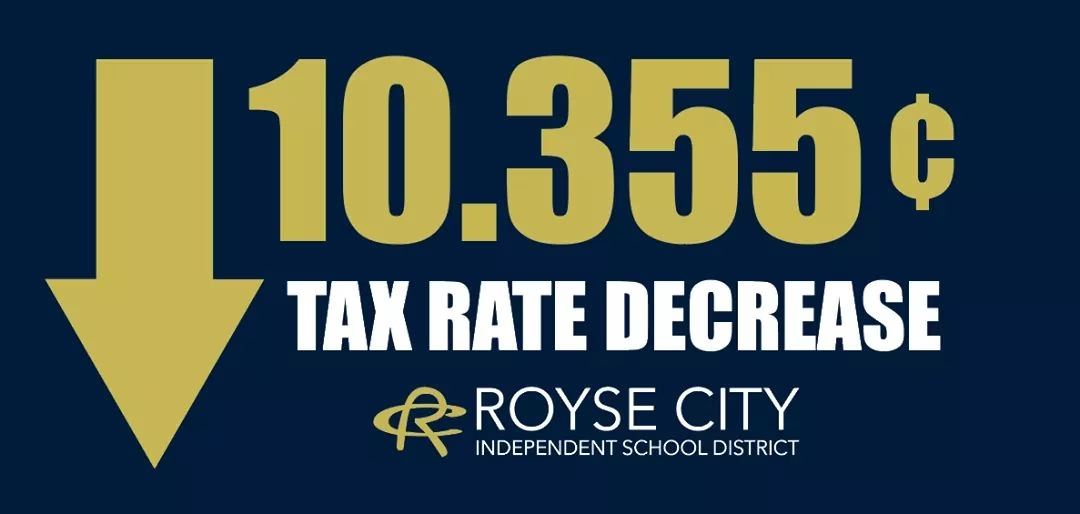

During the August 10 regular meeting, the Royse City ISD Board of Trustees approved a 10.355 cent tax rate decrease. The decrease is on the Maintenance and Operations (M&O) side of the combined tax rate and comes as a result of H.B. 3 that was approved by lawmakers in the Spring of 2019. This time last year, the board approved a 10.165 cent tax rate decrease bringing the two-year total to 20.52 cents.

Longtime school board trustee Bobby Summers said, “In Monday night’s RCISD School Board Meeting, CFO Byron Bryant announced the second significant cut in Royse City ISD School taxes. I have been on the School Board for over 26 years now and I have never seen, nor heard of a cut in school taxes to this magnitude. This is a historical move in Royse City ISD existence. During these uncertain economic conditions, I am very proud of the financial management of our school district. We are now able to pass savings onto our taxpayers during these critical challenges that we are facing.”

For reference a $.20 tax cut represents a $600.00 reduction in a $300,000 home valuation. About 40% of Royse City ISD’s total 2020-21 budget is funded by local property taxes. The state has committed to replacing funds lost by the required tax rate compression.

The Royse City ISD property tax rate is made up of two portions. The Maintenance and Operations (M&O) rate and the Interest and Sinking (I&S) rate. The two portions combine to make the total RCISD property tax rate. The approved combined rate for 2020-20-1 is $1.4648 per $100 valuation; $0.9648 for M&O and $.50 for I&S. M&O funds are used for daily operations and salaries while I&S funds can only be used to pay long-term debt that was previously approved by local RCISD taxpayers.